[slider slider_id=”3083″ responsive=”{"desktop_display":{"selected":"yes"},"tablet_landscape_display":{"selected":"yes"},"tablet_display":{"selected":"yes"},"smartphone_display":{"selected":"yes"}}” _array_keys=”{"responsive":"responsive"}” _made_with_builder=”true”][/slider]

Historical Database

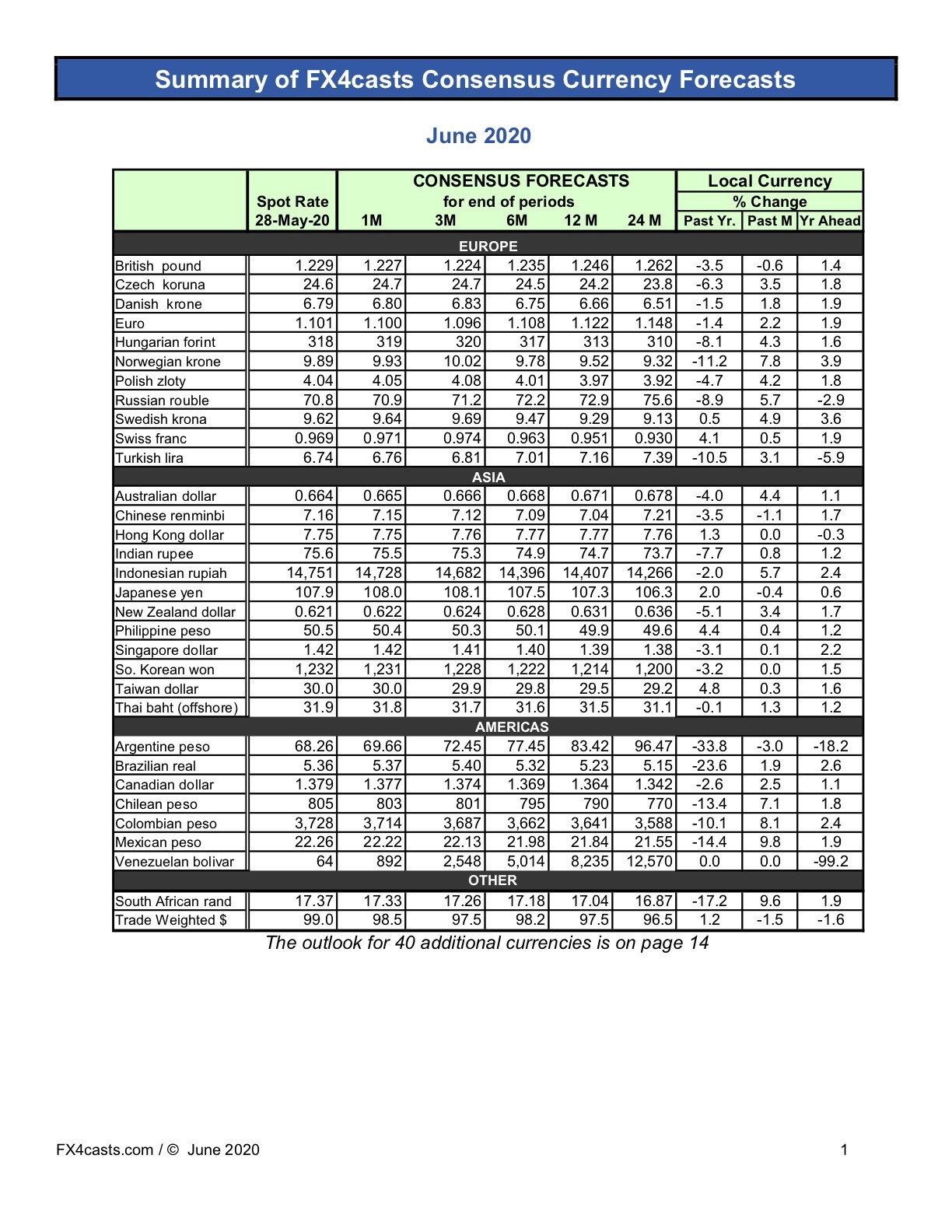

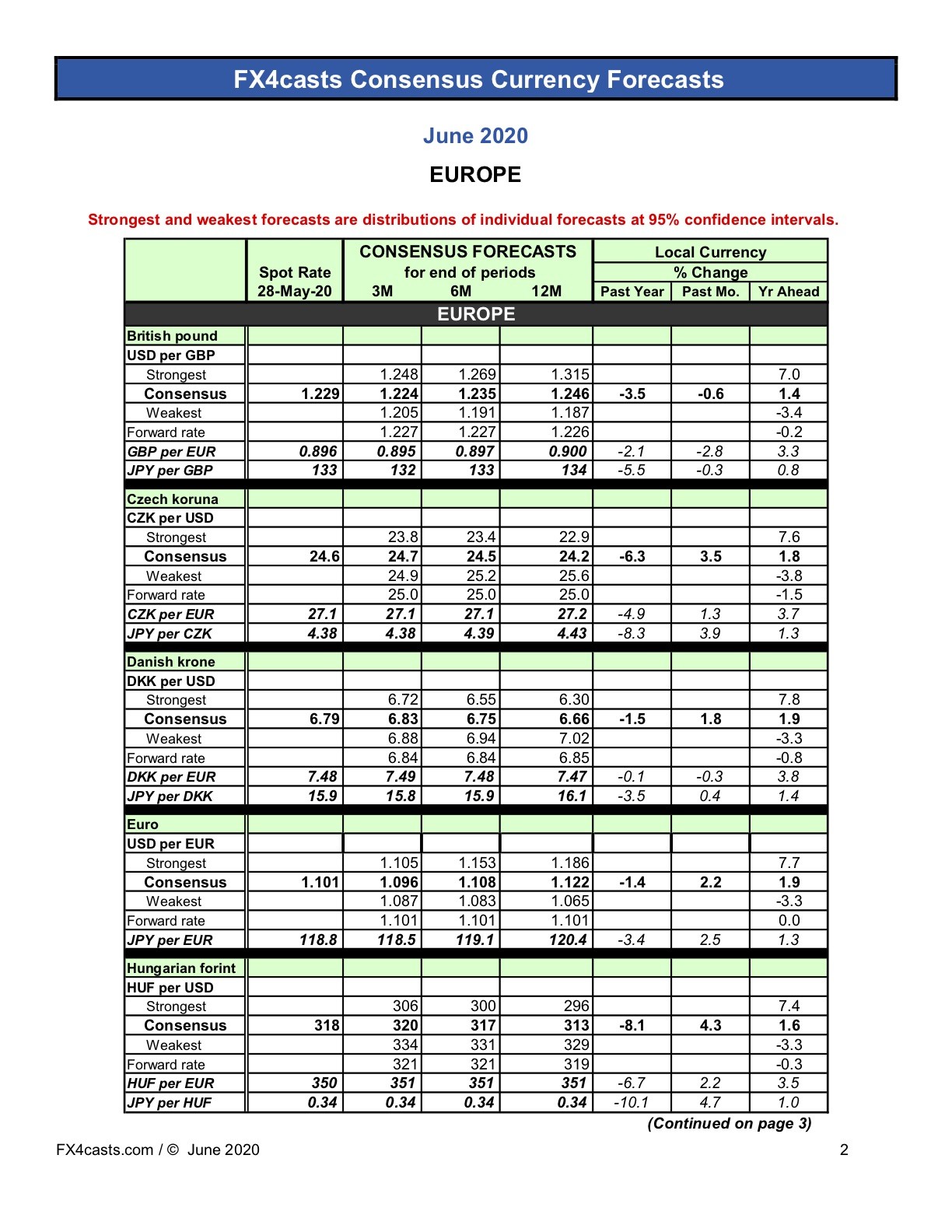

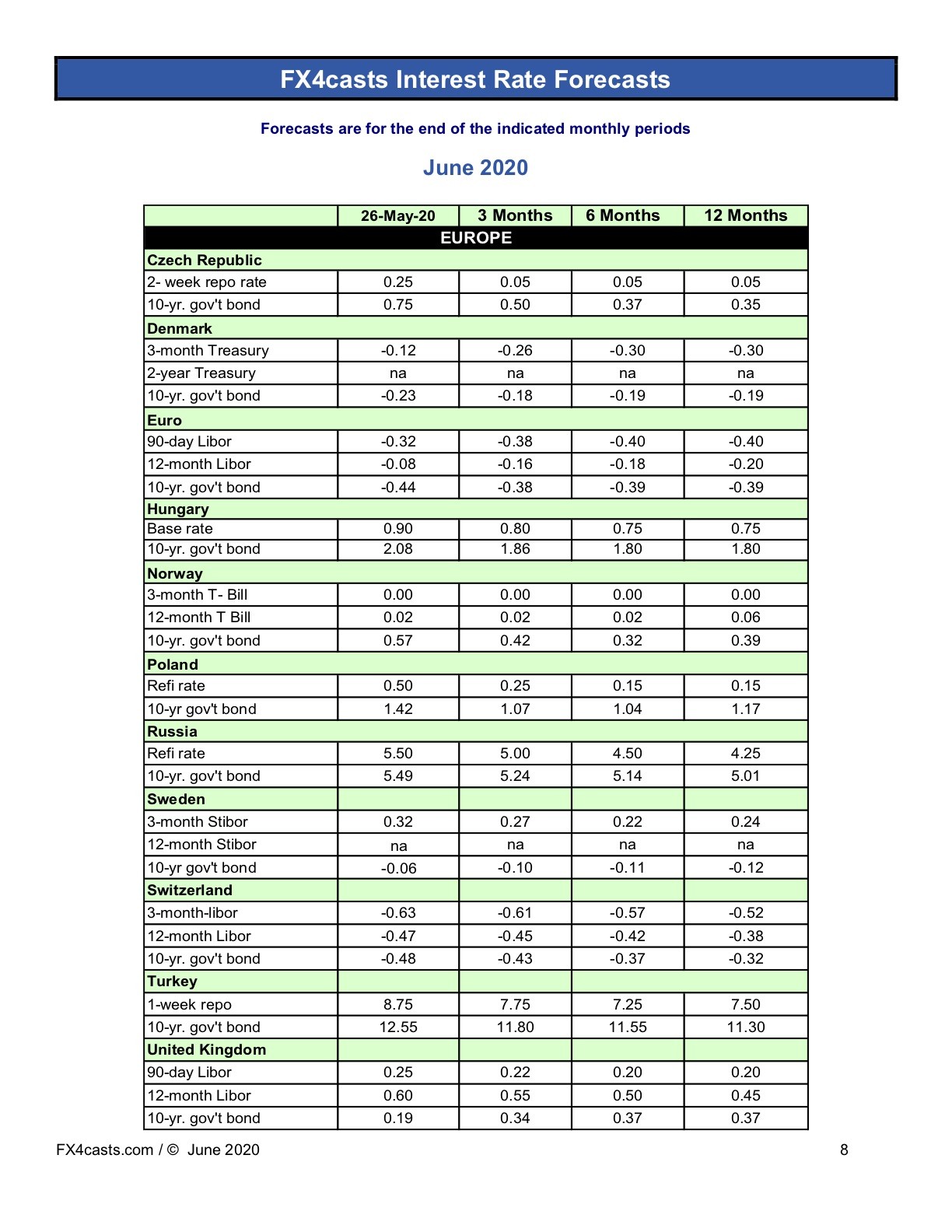

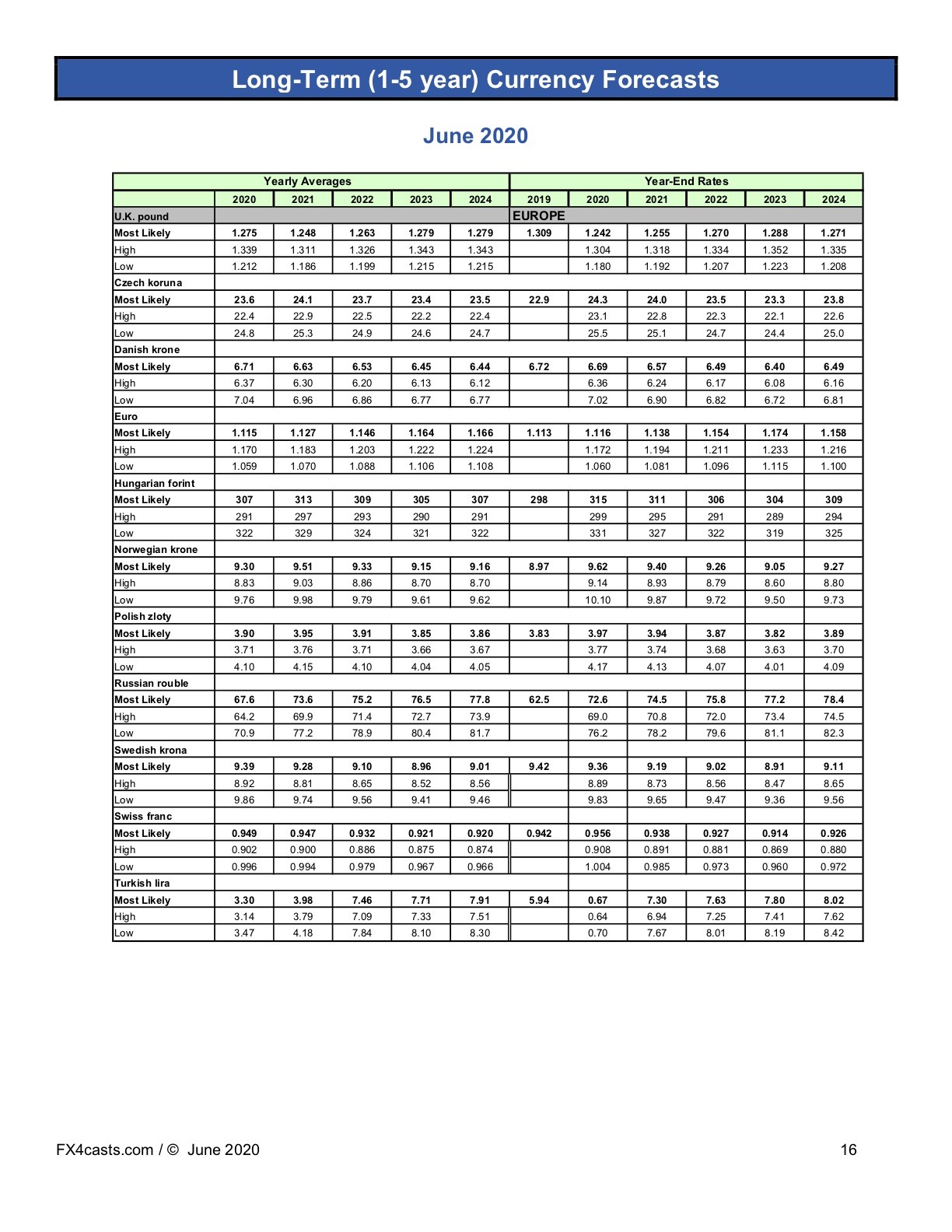

Started in 1986, FX4casts has developed the world’s oldest and most comprehensive database of forecasts for 70 currencies, interest rates and economic indicators globally. The database has been used by researchers at Harvard, Yale, University of Chicago, Wharton, HEC, University of Southampton UK, University of Mannheim and many more. The database can be customized to your specific requirements.

CONTRIBUTORS

Contributors to FX4casts Consensus Forecasts